Review of ib interactive::Does God really exist, as well as Heaven, or are they just ...

Review of ib interactive::Does God really exist, as well as Heaven, or are they just ...

As a teacher, it seems like the quest for teaching materials is never ending. On a teacher's salary it's hard to provide everything your students need. Fortunately, there are many online sites with free lesson plans, worksheets and more. These are some of the best free online sites for teachers. A to Z Teacher Stuff On atozteacherstuff.com, you will find lessons categorized by grade level, theme and subject. In addition, there is a section for worksheets, printable books, nameplates and so much more. There's also a tip section where teacher's post ideas for things such as bathroom use. This may seem silly to some, but with 30 or more kids, it is important to have good bathroom procedures. There's also a forum for those who want feedback or to discuss any ideas. Super Teacher Worksheet At superteacherworksheets.com, there's a printable for everything imaginable. It's nice to have some extra curriculum different than the school curriculum. This site is especially valuable for those teachers who have students at many different levels. For those who do not like worksheets, there are also printable manipulatives like fraction bars, graphic organizers and printable money. Scholastic Although scholastic.com has a store to buy books and other resources, it also has a lot of free resources too. There is a search engine to find specific lessons. Or one can simply browse lesson plans by grade level, subject or theme. For those with Smartboards or other interactive white boards, there is a whole section of games and activities to display on your interactive white boards. There are many printables, usually in PDF form, with fun and unique material. Filamentality If you are interested in creating a website, yet don't have the know how or the money, then go to filamentality.com. It is extremely simple to start a new page and it even has a step by step online guide to help you. In the past, I have used this site to make a hotlist of educational online activities for my class. Education World Find a whole set of templates at educationworld.com. Find graphic organizers, awards, holiday worksheets and icebreakers. There also a lesson plan section, and a special area to encourage technology integration in the classroom. Additionally, find suggestions on classroom management and news on education. Read Write Think Readwritethink.org has a plethora of resources. Along with lesson plans and printables, there is an interactive tool with online activities for kids. There are games, writing tools and inquiry based activities. In addition, there are entire units and recurring lesson ideas. There is a area for professional development and even a parent-afterschool resource section. Internet 4 Classrooms internet4classrooms.com is my go-to site for online demonstrations, lessons and games. This is a great site to use to make a hotlist of activities for kids during computer time. These activities are also good on an interactive white board. My favorite area on this website is the links for PreK to 12. Select a grade level, subject area and then specific skill to work on. Then, be taken to many links for games and activities. Over the years, these online teacher sites have been very helpful to me, and my students. Sources: educationworld.com. filamentality.com. internet4classrooms.com Readwritethink.org atozteacherstuff.com scholastic.com superteacherworksheets.com |

Image of ib interactive

ib interactive Image 1

ib interactive Image 2

ib interactive Image 3

ib interactive Image 4

ib interactive Image 5

Related blog with ib interactive

Related Video with ib interactive

ib interactive Video 1

ib interactive Video 2

ib interactive Video 3

ib interactive

Labels: IB Account Management, IB Brokerage, IB WebTrader, Interactive, Interactive Brokers Account Management, Interactive Brokers Log in, What is International Baccalaureate

Review of ib interactive brokers::How Can I Get the Greeks to Show in the API of Interactive ...

Review of ib interactive brokers::How Can I Get the Greeks to Show in the API of Interactive ...

Image of ib interactive brokers

ib interactive brokers Image 1

ib interactive brokers Image 2

ib interactive brokers Image 3

ib interactive brokers Image 4

ib interactive brokers Image 5

Related blog with ib interactive brokers

Related Video with ib interactive brokers

ib interactive brokers Video 1

ib interactive brokers Video 2

ib interactive brokers Video 3

ib interactive brokers

Labels: IB Brokerage, Interactive Brokers WebTrader, Interactive Trader

Review of ib trader::Can You Smoke a E CIG on Thai Airways

Review of ib trader::Can You Smoke a E CIG on Thai Airways

At the conclusion of each week, VFC's Stock House examines the stocks and stories that made news through various sectors during the previous trading week, but may also make headlines or influence trends during the upcoming week as well. Last week, Investors continued to look for signs that the global economy was on the rebound. The DOW flirted with 13,000, but was unable to hold that mark even as US unemployment numbers looked to be improving. Continued concerns of debt and unemployment in Europe, specifically in Greece and Spain, still weigh heavily on the prospects of overall recovery. Ongoing tough talk from Iran and a potential closing of the Straits of Hormuz has oil prices surging to levels not seen for years and the US consumer is forced to pay nearly five dollars a gallon for gas, not a high level compared to European prices, for example, but high enough to pull a significant amount of free cash flow from the pockets of the retail investor. Last week was also one of numerous high-profile earnings reports from various sectors. Those reports, as outlined below, led to some expected and unexpected volatility, which sets up another exciting trading week. In Sports, the New York Mets published photos of Johan Santana pitching batting practice to Ike Davis during the opening days of Spring Training - which will likely end up being the highlight of the New York Mets' season for 2012. Too bad the Rangers and the Knicks can't carry us through the summer. The next five trading sessions are sure to register a fair amount of continued economic volatility, and there are sure to be some exciting stories to watch. Here's just a few of them: Amarin Corporation (AMRN): Up 12%, down 10% and then up 10% again before another fall. That's the type of week that Amarin Corporation (AMRN) registered last week amid concerns that the company would not be able to secure a key patent for AMR-101, a treatment for very high triglycerides that proved highly successful in multiple key Phase III trials. The volatile moves resulting from the patent concerns have allowed the traders to have a field day with this stock, but the dips might have also allowed longs to load up in anticipation of this summer's projected approval decision by the FDA for AMR-101. As outlined in a recent company report , Amarin filed for approval of its lead product late last year and expects to hear the FDA decision in July. Although the patent concerns are weighing heavily on AMRN's upside for the short term, it's widely expected that the company will eventually secure its desired patent, and general sentiment is also positive that the FDA will ultimately approve AMR-101 for the treatment of high triglycerides, according to some widely circulated media reports and opinions. A solid cash position also reduces some of the inherent risk of an 'FDA decision stock pick', and there is also the potential that buyout or partnership news could be revisited at any time. AMRN soared to nearly twenty dollars last year at the height of such speculation after the announcement of the Phase III results. Given the volatile week that Amarin leaves behind, this will be one of the top stories of the sector to keep an eye on during the coming week. Dendreon Corporation (DNDN): Shares of Dendreon (DNDN) spiked during the opening weeks of 2012 after a preliminary report of rebounding Provenge sales numbers circulated the wires, but the full fourth quarter report and modest projections for the coming months sent shares back towards the ten dollar mark and left many investors wondering if the golden future once predicted for this company will ever regain its traction. Although Provenge sales are still growing, as evidenced by the $77 million in fourth quarter sales, as opposed to the $65 million third quarter number, it is concerns of slowing growth that had investors spooked enough last week to drop the DNDN share price by nearly 20%. "As we look at January, given the end of the year holiday office closures, the physicians saw fewer patients," noted Dendreon President and CEO John Johnson during an earnings conference call on Monday, "Based on the schedules thus far, we expect our first quarter will have minor growth in a low single-digits." The low single-digit growth contradicts general analyst sentiment that had predicted high single-digit growth for the quarter. While shares dipped to below the eleven dollar level last week, they stabilized above that price, indicating that investors still may be far from giving up on this once-high-flyer that saw it's share price above $40 within just the past year. Any sign of stability at the current trading levels could be viewed as a positive moving forward, although the lull time between earnings reports also leaves a chance that ten bucks could be revisited. Dendreon is never void of excitement and storyline, and this week should be no different. Immunocellular Therapeutics (IMUC.OB): A large volume spike last week saw IMUC shares nearly touch three dollars at one point after opening the week at under the two dollar mark. It was positive news regarding this company's lead product, ICT-107 in treating glioblastoma, that led to this stock's run to the mid $2 range last year, but other catalysts have started to unfold that solidify Immunocellular as a solid short to mid term mover while investors await results from the ongoing Phase II trial, which should start coming in late in 2012 into early 2013. A financing deal announced early this year fills the cash coffers enough to last through the initial wave of results release and new institutional interest provides proof that the big boys are starting to take notice of this company and its technology, just as a potential move the AMEX or another large board is being discussed for IMUC shares. An announcement was made by the company last week in which new intellectual property was secured to boost the pipeline and its ultimate potential, another factor that most likely contributed to the swift spike in price and volume. Immunocellular's will be a story to continue monitoring this week, given the high-volumed move of the last several trading sessions. Human Genome Sciences (HGSI): After falling to under seven dollars during the closing weeks of 2011, shares of Human Genome Sciences (HGSI) had rebounded to the ten dollar mark in 2012 before the latest earnings announcement sent them back to below eight bucks amid another round of perceived lackluster Benlysta sales. Benlysta, partnered with Britain's GlaxoSmithKline (GSK) became the first FDA-approved treatment for lupus in over a half century last year and many thought the drug could become an instant blockbuster. Like Dendreon and that company's slagging Provenge sales, however, HGSI's Benlysta has been slow to gain steam on the market and investors continue to grow weary, as evidenced by last week's price drop following the earnings report. Sales jumped to $26 million for the fourth quarter, up from $18 million during the previous quarter, as company officials emphasized in a conference call last week that Doctors are currently viewing this as a "trial period" for Benlysta. While gaining mass acclaim for being the first new lupus treatment in fifty years, Benlysta may also be suffering somewhat from the fact that there is a reason that nothing new had hit market in so long; lupus is one of the most mysterious and hard-to-treat conditions out there, and Doctors want to be convinced that the new treatment works before whole-heartedly prescribing it to patients. If 2012 is still determined to be a "trial year" for Benlysta, as recent analyst comments indicate, then those with an eye towards the longer term many appreciate the once-again sub-eight dollar prices. HGSI is always volatile and always carries the potential of a quick spike, especially if buyout talk is reinvigorated, so with just one week removed from the latest earnings report, this week could be another notable one for shares of this company. Siga Technologies (SIGA): Legal issues , political drama - you name it and Siga's got it. Something else that Siga has, however, is potentially the only orally administered antiviral drug targeting orthopoxviruses that works. The Biomedical Advanced Research and Development Authority of the United States Department of Health and Human Services (BARDA) thought enough of Siga's ST-246 antiviral to award a near half-billion dollar contract to the company last year in a move to fill the nation's biodefense stockpiles as a preparatory response to a potential smallpox bioterror attack. Company shares spiked late last year and early this year after an initial payment was received from BARDA, but volatile trading ruled the days last week when SIGA straddled the three dollar mark before closing down by nearly ten percent on Friday after an uneventful earnings release late Thursday. Reports from various media outlets in early 2012 predicted a four dollar short term share price for SIGA, but shares quicly receded to the current levels once those expectations did not pan out. Many still consider this company a solid long term bet on the basis of its developing technology and the large BARDA contract, which leads to the volatility created by the quick price moves. The short term has proven that this is a better trader's play than a long term hold, but as events play out, both strategies could be rewarded. Last week was a volatile one for SIGA, and the coming week may prove no different. Keep the trading finger ready. Celsius Holdings (CELH.PK): Another earnings release came and went without having much impact on the CELH share price. Fourth quarter results totaled $1.8 million, up from just $103,000 during the same quarter of the previous year, although down from the $2.5 million number announced for the previous quarter. The numbers are another sign, however, that some form of stability has been achieved after the failed high-profile marketing campaign of 2010 evaporated millions of dollars from the marketing budget. While that campaign attempted to quickly launch the calorie-burning Celsius beverage into the mainstream with force, the latest strategy is to return to the small-marketing roots that may not provide instant sales bursts, but may be able to slowly gain traction in the health-minded pre-workout sector. According to last week's press release , "The Company announced today a strategy to expand the Celsius brand through Direct to Consumer initiatives and to restructure and support its retail sales efforts. The campaigns will include DRTV, Affiliate Networks, Banner Advertising, Social and Digital Media, Direct Mail, Viral Marketing and Health Club Sampling." In conjunction with that strategy, a new flavor of the Celsius powder was added to the growing inventory. 'Outrageous Orange" joins the berry flavored powdered packets as an add-to-water option for the Celsius brand. Still a potential growing rebound story, the news has not yet been encouraging enough to spark an all-out move in price and volume, but this is still one to keep on the radar. The trading range has been between twenty and thirty cents of late, and Friday's close was towards the higher end of that spectrum. ALSO WATCH: OncoVista Innovative Therapies (OVIT.OB): OncoVista was highlighted last week at VFC's Stock House for its noticable rise in both volume and price. Another huge leap in volume on Friday, accompanied by a twelve percent price jump, foretells the possibility that something might be brewing behind the scenes for this long-dormant company. The most advanced product in OncoVista's pipeline is OVI-123, known also as Cordycepin, and it was revealed late last year that OncoVista had entered into an agreement with Oncology Therapeutic Development (OTD), a consulting and early Clinical Development focused CRO, to initiate a Phase Ib clinical trial of Cordycepin associated to Pentostatin for the treatment of patients with terminal deoxynucleotidyl transferase (TdT)-positive refractory leukemia. The estimated market potential for Cordycepin is greater than $350 million annually, according to statistics posted in the company's website , and the FDA has already granted the product an Orphan Drug Designation. OncoVista is also developing OVI-117 as a targeted treatment for multiple cancer indications. This product is in the latter stages of pre-clinical development, but may hold greater market potential than Cordycepin, should it make it that far through development to commercialization. Given last week's sharp move higher, this will be one to watch during the coming week as well. InVivo Therapeutics (NVIV.OB): InVivo recently announced the full exercise of its over-allotment option for a recent stock offering, a good indicator that confidence is being built for the company's potentially ground-breaking technology to treat severe spinal cord injuries (SCI). NVIV shares quickly rebounded from the prices of the offering and will be worth keeping an eye on this week - and the months to come - as 2012 is shaping up to become a pivotal year in this company's progression. The long wait for a cure for paralysis may be over, if preclinical studies hold true through the human phases of testing, so don't let NVIV stray too far from the radar. Pharmacyclics, Inc. (PCYC): This one continues to prove me wrong. Although the potential of the Pharmacyclics pipeline and technology is huge, I've expressed my concerns about investing in a company with nothing beyond Phase II that boasts a near-two billion dollar market cap. Others don't seem to share my caution, however, as evidenced by the twenty five dollar share price, but this should continue to be a stock to watch. If the current prices can hold, then it could be a huge indicator that investors are willing to place a higher level in confidence in solid Phase II pipeline products, which could bode well for other 'Phase II' companies in the sector. SiriusSM (SIRI): A renewed push to $2.50 - or higher - may be materializing. Confidence is again growing in this company after solid fourth quarter numbers were announced earlier this month, and a four percent price spike on Friday that was accompanied by some positive press reporting is a sign that the $2.50 mark may come sooner, rather than later. GelTech Solutions (GLTC.OB): Volume has slipped for this early-year high-flyer , and price has followed, but the potential of GelTech to realize pivotal goals this year still remains. The company's lead product, FireIce, could revolutionize the firefighting industry and 2012 is set to become a year of new distribution deals and evolving business plan. Given the recent spike and then quick retracement, this week could be an indicator if the early-year run was a flash in the pan or if another reversal is due to take effect. Cytosorbents Corporation (CTSO.OB): Still hovering around the fifteen cent mark, the recently-silent Cytosorbents may still be priming itself to recognize another milestone year in the company's development. Volume picked up a bit last week, although only modestly from previous sessions, but it was noteworthy enough to put CTSO back on the radar for the upcoming week. With CytoSorb on the market in Europe for the treatment of conditions where high cytokines are present, and with the company methodically advancing its technology, this one is still a sleeper. Keep an eye on these stories and, as always, happy trading. Disclosure: Long CTSO, GLTC, CELH, HGSI, SIGA, NVIV, OVIT, IMUC. |

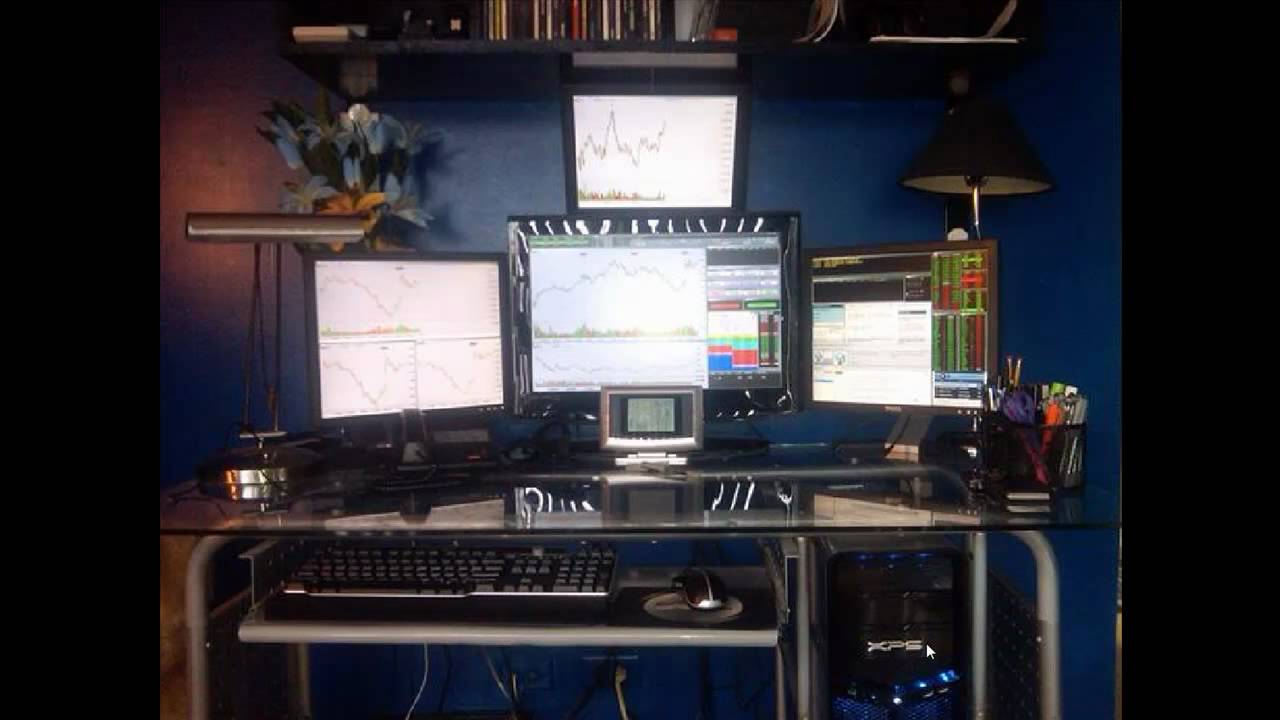

Image of ib trader

ib trader Image 1

ib trader Image 2

ib trader Image 3

ib trader Image 4

ib trader Image 5

Related blog with ib trader

Related Video with ib trader

ib trader Video 1

ib trader Video 2

ib trader Video 3

ib trader

Labels: Download IB Trader Workstation, IB Brokerage, IB Brokers, IB Stocks, IB Trader Workstation, Ibwiki, Interactive Brokers Log in, Interactive Brokers WebTrader