Review of online stock trading comparison::What Time Does the Bond Market Close?

Review of online stock trading comparison::What Time Does the Bond Market Close?

Many newcomers to stock trading cannot tell the difference between a proprietary trading firm and an online (retail) broker. When deciding to open an account, traders make their comparison of brokers based on the relative cost and the products offered, but more often than not they fail to realize that the products are not exactly the same. This article seeks to shed light on the mechanics of a prop trading account and educate traders about the differences between the two options so that one can compare them more effectively. The analysis has been provided in six key areas: software, rebates, fees, buying power, education and short locates (availability of hard to borrow securities). These are the areas in which the two are most distinctively different and are rightfully the most common factors considered in this decision. You as a trader will place a different emphasis on particular categories as you consider whether retail or prop is best for you. Software Retail Retail brokers typically offer the ability to execute trades on their website. Most also offer their own trading platform at a monthly cost to the trader. This fee may be waived if you meet their minimum requirements for account assets. Prop A good prop firm will offer traders a choice between a few different direct access routing programs. A trader's platform provides the ability to execute and monitor transactions quickly and effectively. A proprietary platform will have direct connectivity to the exchange matching engine. Hot keys are also a must have for intraday traders and are a feature offered in proprietary software, but not often that of retail firms. Most proprietary trading platforms provide access to more in depth real-time market data such as NASDAQ's Totalview, ARCA Book, NYSE OpenBook, BATS and Direct Edge Books, although some of this data may come at an additional cost. Greater market depth and breadth can assist the trader in making better trading decisions on very active and heavily traded securities in real-time. Rebates Rebates refer to the compensation that ECNs provide to traders who add liquidity to the market. Most ECNs give rebates to traders who add liquidity and charge a slightly higher fee to traders who remove liquidity from their market center. This is a basic ECN business model, although there are a few ECNs that are structured differently. Retail In the vast majority of cases, retail firms do not pass on rebates to their traders. The online broker will most often route the flow to a low cost exclusive destination which does not cost extra and is not often directly to an exchange. If a retail trader chooses to route to a particular ECN, the additional fee on top of their flat commission rate may be passed through to the trader. Prop Traders who trade at a proprietary trading firm get the advantage of benefiting from the widely adopted "taker-maker" model that most exchanges offer. Traders who add liquidity will receive rebates for doing so in accordance with that exchange's rates (which can be as high as $3/1000 shares). This can be a substantial source of revenue for the prop trader and will also influence his/her decision of which route to use. Fees Retail The fee structure for retail firms will vary from shop to shop and the industry is highly competitive. One firm may offer no account transfer fees while another may advertise no inactivity fees. Still another may not charge for wires, but they may make this up in their commission structure. In general, retail firms have a flat, per trade commission rate that is charged. There is also usually a software fee for the platform unless you meet certain minimum asset requirements or if you are a very active trader. Some other incidental fees that you may incur are those that have been mentioned above. Prop Proprietary trading firms are able to offer more competitive commission and transaction fees than the online broker. Proprietary firms typically use a per share structure with breakpoints for decreasing your commission as your volume increases. This is often a direct benefit to intraday traders who have a high number of trades per day. All prop firms charge a software or desk fee which goes to pay for the data and order entry software that the firm uses. Some offer this software "at cost" to their traders and some charge a premium on top of their cost. The variety of routes offered directly affects the desk fee as well, so ask your prospective shop about the routes available when talking about desk fees. For some traders, more routes is more value added. Day Trading Buying Power Retail In retail accounts, your buying power is THE LESSER OF the equity in your account divided by .30 (the 30% minimum global margin requirement for equities) OR your SMA multiplied by 2 (which satisfies the Regulation T requirements for equity purchases). For day traders, you must have at least $25,000 in equity in order to do more than three round trips (day trades) in a rolling five business day period (FINRA Rule 2520). Outside of this model, certain accounts may be eligible for portfolio margin. Prop With a prop firm, your buying power is determined by the firm you're with and the risk capital deposited. Some traders may be fully backed by a firm (true prop) in which case they can expect the firm to take a portion of profits to compensate for the risk taken. Many traders find trading prop more advantageous as they can trade a lot more capital that they would have access to in a retail account. Day traders with less than $25,000 are prime clients of prop firms as they are able to trade freely without worrying about the minimum equity requirements enforced by FINRA Rule 2520. This is because most prop firms are set up so that traders trade sub accounts of the firm, but the firm "hits the street" as one large account. Education Retail Many retail firms have educational information on their website. The breadth, depth and level of educational materials vary from firm to firm. The material is usually in the form of suggested reading, archived lessons and, occasionally, trading seminars. Prop Offerings for training in the prop field are highly sought after. Many traders who are beginning their trading careers look to prop firms with advertised training programs. Be cautious of firms that charge for educational classes and then provide firm capital for you to trade. Some of these firms are modeled to generate revenue from training which can cause a conflict of interest as their incentive to see traders last in the long run is greatly reduced. When a trader joins a prop firm and deposits risk capital, all compliant firms are required to hold your deposit for 12 months. Afterwards, the trader may receive his/her deposit back. In short, be aware that if a firm charges for training they may be trying to avoid the lock up period so they can treat it as revenue immediately. Shorting/Locates All traders, prop and retail, are subject to Regulation SHO which governs short selling in US markets. Traders must have located shares that they wish to borrow before selling short. Some stocks may be on the threshold list or "hard to borrow" list and may not be available. This list is updated every 24 hours. Retail If a retail trader would like to short a stock on the threshold list, there may be little that can be done to locate additional stock intraday and an opportunity may be missed. Prop Traders with a prop firm may submit locate requests before and during market hours in order to locate additional shares of stock on the threshold list. As it happens, most traders begin trading in retail accounts due to their accessibility and pervasiveness in the investing community. Too many traders are unaware of the options available to them when it comes to cost structure, service and performance. It is my hope that this article will dispel some of the mystery and stigma from prop. Looking at these six areas, you can better determine if your style of trading is more suited for a prop account, or if you would be better off opening an account with a retail broker. When choosing a firm in either category, research is paramount. Make sure your broker or trading desk has a sound reputation and make sure to ask the right questions. Talk to traders or read reviews on forums and trading websites. The better informed you are from the onset, the better your experience will be and the more comfortable you will be doing business with them. Happy trading. |

Image of online stock trading comparison

Related blog with online stock trading comparison

Related Video with online stock trading comparison

online stock trading comparison Video 1

online stock trading comparison Video 2

online stock trading comparison Video 3

online stock trading comparison

Labels: Best Online Brokerage Firms Comparison Chart, Best Online Brokers 2013, Best Online Stock Trading, Best Stock Trading Site, Best Stock Trading Site for Beginners, How to Trade, Online Stock Trading, Stock Trader Comparison

Review of stock brokers online::A Basic Description of What a Stock Broker Does

Review of stock brokers online::A Basic Description of What a Stock Broker Does

Not all online stock brokers are the same. Some offer better customer service, some may cater to people with higher net worth or to those with only a few spare dollars to invest. This guide will show you what to look for in a broker, and how it applies to you. Account Maintenance Fees - If you find a stock broker that charges account maintenance fees, then walk away immediately. Most brokers do not have them, and this is a sneaky way to derail your investments, and eat away at any potential gains you will make. Find a better offer with another brokerage firm. Trading Fees - Standard stock trading fees are around $10 plus or minus. Beware of brokers that charge only a couple dollars or less per trade. Do they sacrifice customer service? Do their trades go through immediately or does your broker pool them with other trades to save costs? If so, are these trades cheaper? Some brokers have different pricing programs for traders of different net worth or different investment needs. Execution - Does the broker offer realtime trades? Some brokers will save costs by pooling your trades with other customers trades, delaying the execution of the trade. Customer Service - Can you pick up the phone and call your broker if you have a problem or need investment advice? Joining Bonuses, Cash, and Free Trade Offers - Avoid being enticed by these offers since you'll probably stay with your broker for years or more, and a one time offer will not make much of a difference in the long term. Be sure your broker cares just as much for its current customers as it does for its new customers. Talk to friends who have experience with online brokers, read reviews, and do your research before committing to any one broker. You may have to read the fine print if your broker does not show its terms upfront. Good luck. |

Image of stock brokers online

Related blog with stock brokers online

Related Video with stock brokers online

stock brokers online Video 1

stock brokers online Video 2

stock brokers online Video 3

stock brokers online

Labels: Best Stock Trading Site for Beginners, Compare Online Stock Brokers, Online Stock Broker Review, Online Stock Brokers for Beginners, Online Stock Brokers List, Online Stock Trading for Beginners, Penny Stocks Broker Online, Stockbrokers

Review of online trading broker::How to Buy and Sell Stocks

Review of online trading broker::How to Buy and Sell Stocks

While hanging out on some random money making forum I ran across one user who suggested we all try out a certain FOREX website and bragged about how he had made one-hundred dollars in a month. While I knew trading against the FOREX, or Foreign Exchange Market, was hot at the moment I had never actually ventured to any of the many websites. Always the cynic, I thought I would check this particular website out. This particular FOREX site seemed like many other dodgy money making websites with generic stock photos, limited time reduced sign-up fees and promises to pay. Without knowing anything about the ins and outs of FOREX sites, it sounded like a good deal but since I had seen so many poorly-written FOREX ads around the Internet I decided to dive in a little further. I went to a link on the homepage which said, "Withdraw" and I was prompted to open a MS Word document. Right then red lights started going off in my head. In order to collect your money you had to list your personal information, all of your bank account information and then fax it off to a number in the British Virgin Islands. Anyone who is Internet savvy would know not to send this information over an unsecured website, let alone to some random fax number. This finding led me to do a little more research on this online FOREX phenomenon and the results were less than promising. Most FOREX trading websites I ran across seemed on the up and up on first look but many of them required personal bank account information to be mailed or faxed to a nondescript address or phone number. I quickly noticed that most of these websites did not originate in the United States and all of the FOREX ads I've seen lurk around websites commonly visited by foreigners, especially Indians for some reason. These scam artists seem to be targeting those from other countries who try to use the Internet to make a quick buck. Online money making forums are stacked with foreigners who sincerely think they just struck gold in FOREX and try to get others to join in without doing the basic research to see if the operation is legit or not. The best way to play the FOREX market is to avoid online trading websites. If you are serious about investing in the FOREX, hiring a broker is your safest bet, although stay away from any broker who claims FOREX is a safe way to invest because it is in fact very risky. Also stay away from those who say you can make $1000 every week. Regulation of legitimate FOREX trading falls under the Commodity Futures Trading Commission (CTFC) and are protected by familiar organizations such as the FDIC (Federal Deposit Insurance Corporation) and even the Federal Reserve just to name a few. The CTFC first became aware of FOREX scams back in 2000. They promptly published a Foreign Currency Trading Fraud Advisory, which teaches the public what key words (mainly hyped-up phrases to lure people in) to look out for and where they can go to check out or report a fraudulent website. This advisory can be found online at: http://www.cftc.gov/opa/enf98/opaforexa15.htm . FOREX scams seem to target foreigners more than Americans as scammers will place FOREX ads in foreign newspapers and they are heard on radio ads in poor areas, but with the popularity of pay-to-click and pay-to-read (PTC and PTR, respectively) websites, the scam is starting to spread to innocent Americans looking to make a quick buck online. The best rule of thumb remains, "If it sounds too good to be true, it probably is." |

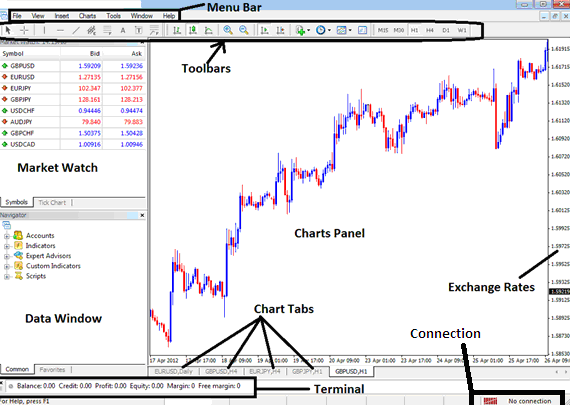

Image of online trading broker

Related blog with online trading broker

Related Video with online trading broker

online trading broker Video 1

online trading broker Video 2

online trading broker Video 3

online trading broker

Labels: Best Brokerage Account, Best Day Trading Brokers Online, Best Online Trading Site for Beginners, Best Stock Trading Site for Beginners, Compare Online Trading Brokers, Day Trading Online Broker, Discount Online Stock Trading, Online Brokerage Comparison